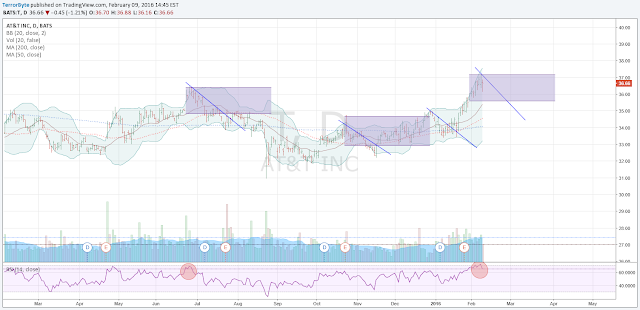

This symbol has been on my watch list for some time now. Posted the following chart a couple of weeks ago about the double bottom base and the entry point of $23.68. Here goes the chart.

It broke through that entry price target today and is holding up. With earnings coming up on 09Mar16, I might wait till after earnings before I get in. Here goes today's chart.

It broke through that entry price target today and is holding up. With earnings coming up on 09Mar16, I might wait till after earnings before I get in. Here goes today's chart.